I disagree. Getting into debt is not a math problem. Its a you problem.Pay off higher interest loans first, regardless of principle balance. It's not wizardry, it's math.

Aside from your house, don't take on any debt that doesn't generate income or project to appreciate in value. You can use some mental gymnastics there, but pay for toys in cash.

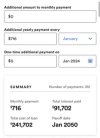

I believe in the debt snowball method. It keeps people motivated to keep it going.

Paying off the higher interest loans first is math wise smarter, but Its hard for people to stick with it when they see no progress